Who rules the DEX arena—Uniswap’s simplicity, Curve’s stability, or Balancer’s flexibility?

In the fast-paced world of decentralized finance (DeFi), decentralized exchanges (DEXs) have become the lifeblood of token trading. These platforms enable permissionless swaps, liquidity provision, and governance—without relying on intermediaries. Among the crowded field, Uniswap, Curve, and Balancer have emerged as three of the most influential and innovative DEX protocols, each with a unique approach to liquidity and market design.

In this deep dive, we dissect how these protocols stack up—by use case, tokenomics, performance, and long-term potential. Whether you’re a liquidity provider, yield farmer, or DeFi enthusiast, this is the showdown you don’t want to miss.

🔄 The Core Models: AMMs at Their Best (and Most Specialized)

🟣 Uniswap: The Pioneer of Simplicity

Uniswap introduced the concept of automated market makers (AMMs) to the masses with its constant product formula (x * y = k). Its appeal lies in minimalism:

- Simple pools: 50/50 asset ratios

- Permissionless listing: Any ERC-20 pair can be added

- Concentrated liquidity (introduced in v3): Liquidity providers (LPs) can provide capital within specific price ranges, improving capital efficiency.

Uniswap has evolved from a novel concept in 2018 to a dominant DEX that consistently ranks at the top in daily volume.

“Uniswap is the DEX that just works—simple, efficient, and battle-tested.”

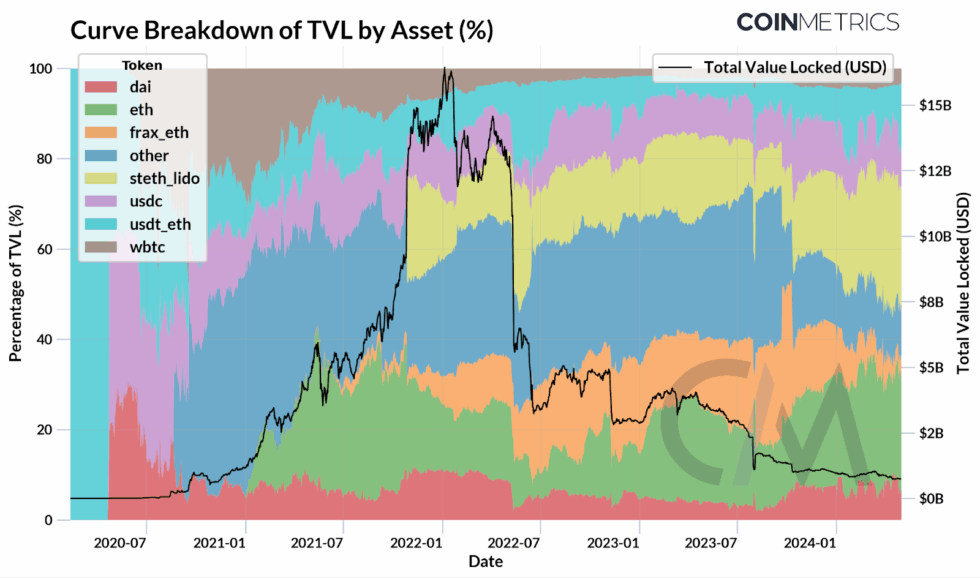

🔵 Curve: The Stablecoin & Staked Asset Specialist

Curve focuses on low-slippage swaps between similarly priced assets, especially stablecoins and derivative tokens like stETH/ETH or USDC/DAI.

- Custom bonding curves: Designed for assets with minimal volatility

- Boosted rewards: CRV emissions are influenced by veCRV token locking, creating a flywheel of liquidity and governance participation

- Pool incentives: Partners can incentivize pools through bribes or gauges

Curve has become the backbone for stablecoin liquidity in DeFi and is essential for protocols like Lido and Frax.

“If Uniswap is the generalist, Curve is the precision-engineered specialist.”

⚫ Balancer: The Flexible Architect of DeFi Liquidity

Balancer is known for its customizable liquidity pools, allowing:

- Multi-token pools (e.g., 80/10/10 or 40/30/30/…)

- Dynamic fee structures

- Smart pools and managed portfolios (e.g., index funds like BAL80/ETH20)

Balancer’s innovation has led to advanced use cases such as automated portfolio management, rebalancing, and protocol-managed liquidity.

“Balancer is DeFi’s Swiss Army knife—versatile, customizable, and highly programmable.”

📊 Volume, Liquidity & TVL: Who’s Leading in 2025?

Let’s compare the numbers as of mid-2025:

| Metric | Uniswap | Curve | Balancer |

|---|---|---|---|

| 24h Volume | ~$1.4B | ~$550M | ~$130M |

| TVL | ~$4.2B | ~$3.6B | ~$820M |

| Top Use Case | General token swaps | Stable/staked asset swaps | Index & portfolio pools |

| Chains Supported | Ethereum, Arbitrum, Optimism, Base, Polygon | Ethereum, Arbitrum, Polygon, Fantom | Ethereum, Arbitrum, Polygon, Avalanche |

Uniswap leads in raw volume and user base, while Curve dominates stable assets. Balancer’s niche is smaller but important—especially for DAO treasury management and custom liquidity structures.

🔁 Tokenomics: Utility vs. Governance vs. Incentives

🪙 UNI (Uniswap)

- Governance token with no built-in revenue sharing (yet)

- Holders vote on protocol upgrades, fee switches, and treasury allocation

- Discussions ongoing about activating fee sharing with stakers or ve-model

Strength: Strong brand and liquidity

Weakness: No current yield for token holders

🪙 CRV (Curve)

- Central to veCRV model: locking CRV earns vote power and boosts

- Incentivizes long-term participation and liquidity bootstrapping

- Ecosystem around Curve (Convex, Yearn, StakeDAO) built entirely around maximizing veCRV impact

Strength: Powerful incentive loop for liquidity

Weakness: Tokenomics complexity and inflation

🪙 BAL (Balancer)

- Uses veBAL model: Lock BAL to vote on gauge weights (liquidity incentives)

- Supports smart LP strategies and third-party bribes for pool prioritization

- Encourages DAO and protocol integration

Strength: Strategic partnerships (Aave, Aura Finance)

Weakness: Lower retail visibility

“Tokenomics are the engine of DeFi—and Curve runs a Formula 1 car, while Uniswap still idles at the pit stop.”

⚙️ User Experience & Innovation

- Uniswap wins on UX. Clean interface, fast swaps, and deep integrations across wallets (MetaMask, Coinbase Wallet, etc.).

- Curve lags in UI, though protocols like Curve v2 and aggregators (e.g., Yearn, LlamaLend) help simplify interactions.

- Balancer appeals more to advanced users and DAOs managing liquidity rather than retail users.

Notably:

- Uniswap v4 is in development, aiming to add hooks, allowing custom behavior in pools.

- Curve’s introduction of crvUSD (a native overcollateralized stablecoin) adds another layer to its stablecoin strategy.

- Balancer’s Composable Stable Pools offer capital-efficient swaps for correlated assets—like a hybrid between Curve and Uniswap.

🧠 Strategic Use Cases: Which DEX for What?

✅ Use Uniswap if:

- You’re swapping volatile ERC-20 tokens

- You want access to the most liquid markets

- You’re a casual trader or new to DeFi

✅ Use Curve if:

- You’re trading stablecoins or LSDs (stETH, rETH, etc.)

- You want low-slippage swaps between pegged assets

- You’re farming yield with high capital efficiency

✅ Use Balancer if:

- You want to create or invest in a token index

- You’re a DAO managing treasury or incentivizing complex pools

- You value custom weights and programmable liquidity

🔮 Looking Ahead: The Future of DEX Competition

In the modular DeFi landscape of 2025, no single DEX can dominate every use case. Instead, we’re seeing increasing specialization and cross-chain collaboration:

- Uniswap continues to expand cross-chain and may unlock value with v4’s customizability.

- Curve is deepening its control over the stablecoin economy with crvUSD and LSD integrations.

- Balancer is evolving into the infrastructure layer for programmable liquidity, increasingly used by DAOs and protocols.

“The DEX space is no longer a race—it’s a multiverse. Each protocol thrives in its own dimension.”

🧠 Final Thoughts: Picking Your Protocol

The DEX ecosystem has matured, and with that maturity comes choice. Each of the major players—Uniswap, Curve, and Balancer—offers distinct strengths and caters to different users and use cases.

- Want simplicity and deep liquidity? Go with Uniswap.

- Need stablecoin efficiency or staked ETH liquidity? Curve is your play.

- Building an index or managing a DAO treasury? Balancer has the tools.

In DeFi, understanding protocol strengths is key to unlocking yield, minimizing slippage, and optimizing your capital. Don’t just trade—trade smart.