Is the king reclaiming its throne, or are the rebels gaining ground?

In the ever-evolving crypto ecosystem, one of the most watched metrics among traders and analysts is the Bitcoin Dominance (BTC.D) index—a ratio that compares Bitcoin’s market capitalization to that of the broader cryptocurrency market.

At the heart of market cycles lies this tug-of-war: Bitcoin dominance versus altcoin momentum. Understanding this dynamic isn’t just a technical exercise—it’s a strategic advantage. Whether you’re positioning for a bull breakout or preparing for a drawdown, BTC dominance offers critical insight into risk appetite, capital rotation, and market sentiment.

So, let’s break down the numbers, trends, and strategies that flow from this age-old battle between Bitcoin and everything else.

🔍 What is Bitcoin Dominance?

Bitcoin dominance (BTC.D) is a metric that shows what percentage of the total crypto market cap is held by Bitcoin. For example, if the entire crypto market is worth $2 trillion, and Bitcoin’s market cap is $1 trillion, the dominance would be 50%.

Why it matters:

- It signals where capital is flowing in the market.

- It offers clues on whether investors prefer relative safety (Bitcoin) or riskier bets (altcoins).

- It helps define market phases: accumulation, altseason, or flight to safety.

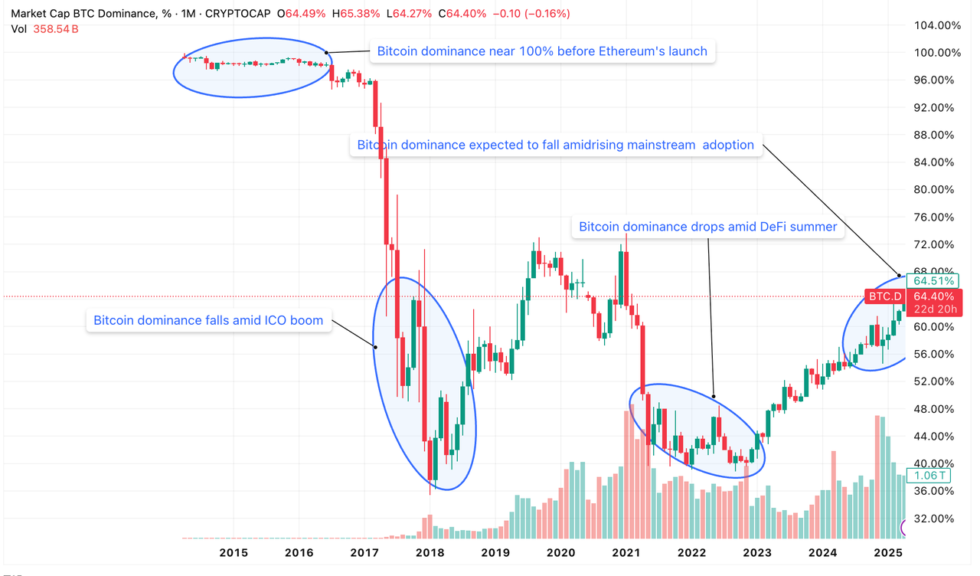

📈 Historical Perspective: Boom, Bust & Rotation

Let’s explore some key moments in BTC dominance history:

- Early 2017: BTC.D was around 85%. Bitcoin was the overwhelming market leader.

- Late 2017: As ICO mania exploded, BTC.D plummeted to ~35%, marking the rise of altseason.

- 2021 Bull Run: BTC dominance ranged between 40–70%, dropping significantly during periods of high altcoin speculation.

- 2022–2023 Bear Market: Dominance surged back above 50% as investors retreated to perceived safety during market uncertainty.

Current Trend (Mid-2025): BTC dominance sits near 52–54%, suggesting Bitcoin remains the anchor—but altcoins are beginning to claw back momentum in selective sectors like AI, DeFi 2.0, and restaking.

🧠 The Psychology Behind BTC.D Fluctuations

High BTC Dominance tends to reflect:

- Cautious market sentiment

- Bearish or uncertain macro conditions

- A preference for liquidity and lower volatility

Low BTC Dominance often signals:

- Bullish risk-on environment

- Speculative surges in altcoins, NFTs, and memecoins

- Broader retail participation and FOMO-driven activity

“When dominance drops, dopamine rises—altcoin traders live for the chaos of low BTC.D environments.”

📊 Altcoin Momentum: When and Why It Surges

Altcoin rallies typically follow a predictable (but not guaranteed) pattern:

- Bitcoin Breakout Phase

BTC surges, absorbing capital and dragging up the entire market. - Profit Rotation Phase

Investors begin rotating profits into altcoins—first large caps (ETH, SOL), then mid-caps (LINK, AVAX), and eventually into small caps and memecoins. - Full-Blown Altseason

BTC dominance drops fast. Even low-quality projects see massive pumps. Risk is thrown out the window. - Distribution & Collapse

Momentum slows. Liquidity dries up. BTC regains dominance as altcoins correct heavily.

Key Indicators of Altcoin Momentum:

- Declining BTC dominance with rising total market cap

- Surges in Layer 1 and Layer 2 tokens

- Spike in trading volumes for low- and mid-cap altcoins

- Increased Google Trends/searches for “altseason”

⚖️ Ethereum’s Role in the Balance

Ethereum (ETH), as the largest altcoin, often serves as a bellwether for altcoin momentum. Many analysts track ETH/BTC as a leading indicator of risk appetite.

- Rising ETH/BTC ratio: Suggests altcoins are gaining strength relative to Bitcoin.

- Falling ETH/BTC: Indicates capital is flowing back to Bitcoin or into stablecoins.

In 2025, the ETH/BTC pair has hovered near 0.058–0.062, showing sideways action and indecision in broader altcoin markets. However, with Ethereum upgrades underway and renewed L2 adoption, some speculate that altcoin flows may soon accelerate.

🧪 Tactical Use of BTC Dominance in Portfolio Strategy

Understanding BTC dominance isn’t just academic—it can inform tactical positioning:

1. Bullish on BTC Dominance (High/Increasing BTC.D):

- Favor BTC-heavy portfolio

- Reduce exposure to speculative altcoins

- Prepare for macro risk or downtrend conditions

2. Bearish on BTC Dominance (Declining BTC.D):

- Increase exposure to high-quality altcoins (ETH, SOL, ARB, etc.)

- Consider rotating profits into mid- and low-cap projects during peak sentiment

- Take profits aggressively—altseasons can turn quickly

3. Neutral BTC.D with Rising Total Market Cap:

- Signal of broad market growth

- Possible accumulation phase before next rotation

- Balanced portfolio with BTC, ETH, and select altcoin exposure

“Dominance is not a signal on its own—but when paired with volume, sentiment, and macro—it becomes a tactical compass.”

🧭 External Influences on BTC Dominance

Several external factors can distort or amplify BTC dominance trends:

- ETF Approvals: Spot BTC ETF inflows often increase BTC.D temporarily.

- Regulatory Headlines: Crackdowns on altcoins tend to push capital back into BTC.

- Major Hacks/Scandals: Fear events often spark a flight to Bitcoin safety.

- Macro Data (Fed, CPI, Employment): Strong macro risk events can either fuel or drain overall market risk appetite, impacting dominance.

🔮 What the Current Data Tells Us (July 2025)

- BTC Dominance: ~53.2% (up slightly from last month)

- Total Market Cap: ~$2.9 trillion

- ETH/BTC Ratio: 0.060 (neutral zone)

- Altcoin Volume Share: Increasing slowly on centralized exchanges

- Layer 2 Activity: Growing rapidly—watch for spillover into L2 tokens

Interpretation: We’re in a pre-rotation phase. Bitcoin is strong, but signs of brewing altcoin interest are emerging. High-cap altcoins may lead the next wave before a full-blown altseason emerges.

🧠 Final Thoughts: Don’t Fight the Flows

Bitcoin dominance isn’t just a chart—it’s a sentiment barometer, capital rotation map, and risk signal all in one. In the world of crypto, where volatility is currency, knowing when to ride with BTC and when to pivot to alts can mean the difference between gains and regrets.

“Follow the money. Follow the dominance. Everything else is noise.”

Stay nimble, stay data-driven, and always pair technical signals with narrative context. Because in crypto, dominance today can be dethroned tomorrow.